sports betting in ct taxes

Kentucky Sports Betting Tax Rate. Regardless of income you will have a flat state income tax rate of 5.

Free Gambling Winnings Tax Calculator All 50 Us States

Officials in Connecticut have been arguing that allowing sports betting will help to bring a massive surge of tax revenue.

. The state taxes online sports betting at 1375 percent and online casino games at 18 percent with that rate rising to 20 percent after five years. Whether gambling winnings are subject to Connecticut income tax depends on whether or not the winner is a Connecticut resident. 12000 and the winners filing status for Connecticut income.

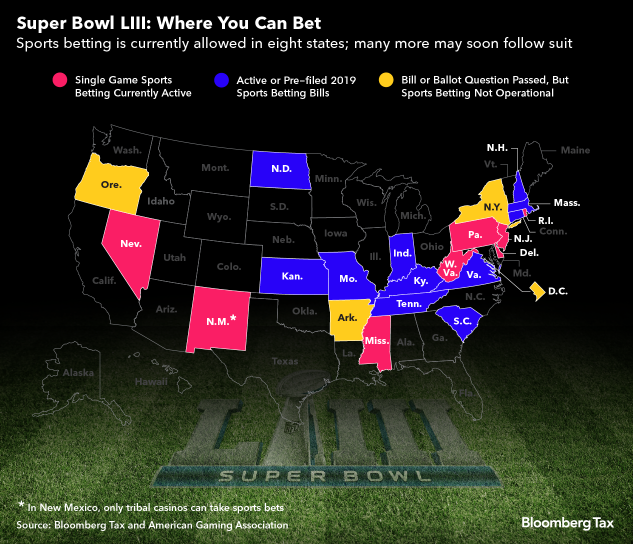

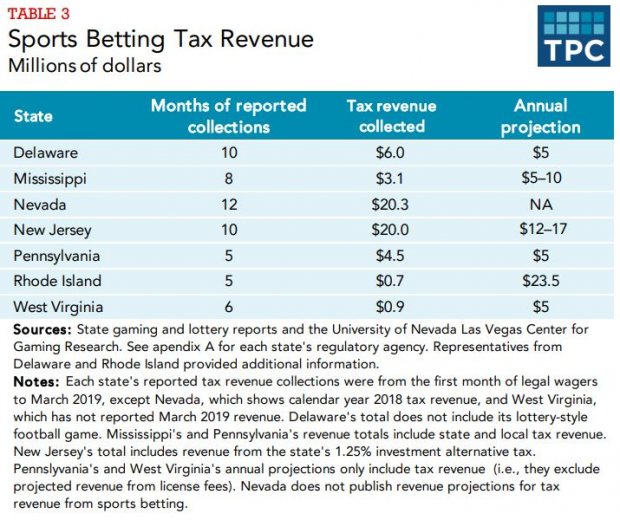

32 rows How States Tax Sports Betting Winnings. Kentucky has a simplistic tax rate that is flat across the board. Sports betting can be legalized at the state level since 2018 and states all across the country are looking at legalizing and taxing online betting.

19 and the state reported. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income exceeds. If the winner is a resident of Connecticut and meets the gross.

In June Connecticut state collected 94 million as revenue from 1152 million from online sports betting. By August 2022 the states three online sportsbooks and retail betting through the CT Lottery contributed to 859094 in taxes that were paid from 76 million in July revenue. While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax.

Since PASPA was repealed by the Supreme. Gambling losses can be deducted up to the amount of gambling winnings. Fortunately you can deduct losses from your gambling only if you itemize your deductions.

This rate applies equally to both the. The state taxes sports betting revenue each month from three master licensees. Is It Our Responsibility to Report Sports Betting Winnings as a Taxable Income.

It is projected to. An 18 percent tax rate for the first five years on new online commercial casino gaming or iGaming offerings followed by a 20 percent tax rate for at least the next five years. The state will collect taxes of 18 initially on online casino gambling increasing to 20 after five years.

May saw the collection of 1319 million in. Online casino gaming and sports betting has been live in Connecticut since Oct. And 1375 on sports betting and fantasy sports.

2 2021 219 pm. This translated to 19 million in tax. Tax payments from sports betting operators in February were the lowest yet.

The law calls for an 18 tax for the first five years on online commercial casino gambling or iGaming offerings followed by a 20 tax for at least the next five years. Last Thursday Yahoo officially exited the Connecticut fantasy sports marketplace in response to the states new law that requires any sports gambling or fantasy. Yes it is because everything that we win while were gambling or doing sports betting is a.

Lately members of the Connecticut Lottery Corporation. Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering.

Michigan Looks At Tax Deduction For Betting Losses

States Bet Big On Sports Gambling Is It Paying Off

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Paying Tax On Sports Betting Here S What You Need To Know

Ct Online Sports Betting Best Sportsbooks Apps In Connecticut

Sports Betting Taxes If You Bet In 2021 The Taxman May Be Coming Marketwatch

Michigan Online Gambling Anniversary Online Casinos Made The Most

February Figures Show Volatile Business Of Sports Betting In Connecticut

Online Sports Betting Taxes How To Pay Taxes On Sports Betting

Connecticut Sports Betting Operators Beat Out Their Bettors In August

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Landing Page Sports Betting For Ct Powered By Sportech

New York Looking To Tax Sports Betting Operators At A 50 Rate

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

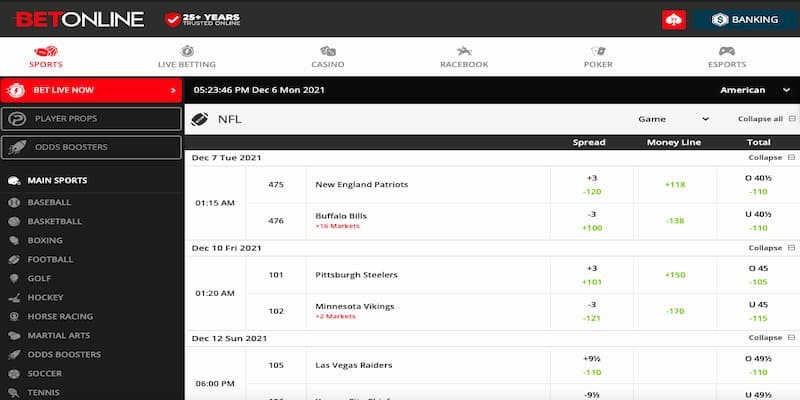

Connecticut Sports Betting Is It Legal Best Ct Betting Sites 2022

Foxwoods Ups Ante On Sports Betting With Draftkings Deal Ct News Junkie